Exchange rates drive the returns exporters receive on the global market upwards and increases the price we pay for imported inputs. This is because if our dollar is weak, from a currency value, for example the American consumers they get $100 AU value for their $60 spend on Australian goods, as the exchange rate increase, they have to spend more US$. For exporters, the decline in exchange rates in all our major trading partners since late October 2024 for the US currency and late June 2024 for Japan and China has improved our export value.

The issue for businesses is, if the market focus is on local consumers this increases the cost of production and reduces the profit margins. It also means that imported consumer goods are more expensive that locally manufactured goods and services. This feeds into the CPI and can drive inflation upwards. This makes it harder for the RBA to manage interest rates as a mechanism to control inflation.

For some sectors such as agriculture, the declining exchange rate is a double-edged sword, as we are increasingly importing in general over a longer time frame, our inputs such as fertilizer, energy, machinery and fabricated parts. This can increase input cost of production and like other sectors will reduce profit margins (although due to global production and demand, prices for a number of our inputs such as fertiliser and fuel are lower). This increases our production cost and reduces competitiveness. It also drives up inflation due to the increased cost to consumers. The upside is for the sectors that focus on exports, this increases the value of the exported products partially offsetting the increased cost of inputs.

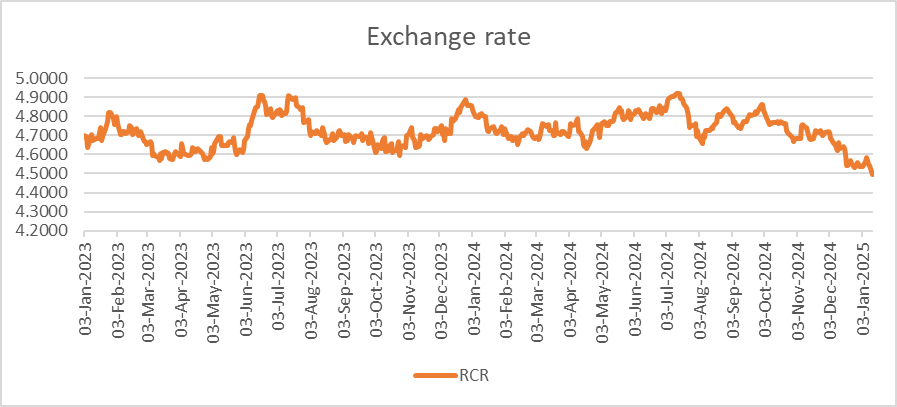

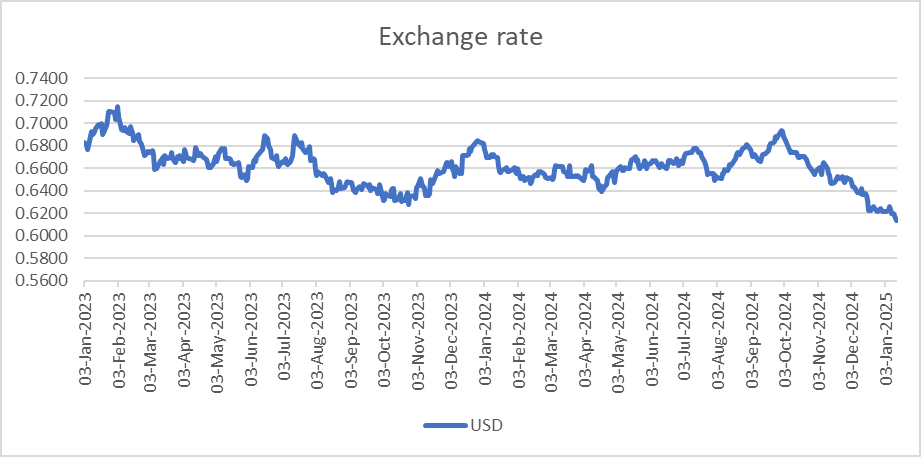

Note in charts 1, 2 and 3 the decline in value of the Australian Dollar with our three main trading partners, especially the China renminbi and the US$. As a significant proportion of foreign exchange is conducted in US$, regardless of country of origin, this means our inputs are becoming increasingly more expensive. Considering that since early 2020, both the US$ and Chinese renminbi exchange rates are trending downwards. This will be good for our exports, but bad for the cost of our input.

Chart 1 Chinese currency exchange rates

Chart 2US$ exchange rates

The change in the past 2 weeks has been significant, the US $ has declined in value since July 1 2024 in all currencies, note table 1 below. As the USA and China are increasingly a source of our inputs, this can have an impact on businesses that focus on the local economy.

Table 1 Depreciation of AU$ compared to three main trading partners

| USD | RCR | JY |

| -8.02% | -7.22% | -10.01% |

How can we manager the potential impact. Managing all competitive pressure, businesses have to be more efficient, this means improving labour, energy and material use performance. To achieve this objective, a business should focus on planning, innovation and adopting a business best practice framework.

Good luck

I’ve been following your blog for quite some time now, and I’m continually impressed by the quality of your content. Your ability to blend information with entertainment is truly commendable..